- At FY 2025 start, the top 11 listed developers announced 253.16 Mn sq. ft. of new housing supply over the next few years

- Of this, just 57.15 Mn sq. ft. (23%) were launched in H1 FY 2025 (Apr.-Sept. 2024) – strong launch pipeline over the next few quarters (2025)

- Among listed players, Bengaluru-based Prestige Group has maximum (75 Mn sq. ft.) new supply planned; just 10.05 Mn sq. ft. launched in H1 FY2025

- Listed players raised INR 12,801 Cr via QIPs in 9M 2024 – RE was 2nd highest among all sectors

- Inventory overhang across top 7 cities at its lowest of 14 months by 9M 2024-end

New housing supply in 2024 remained relatively tepid compared to peak-year 2023 due to elections-related approval delays in H1, and state elections in H2. However, there will be a spurt of new housing supply by listed developers in 2025.

ANAROCK's data analysis of the top 11 listed developers (*) shows that at the beginning of FY 2025, they announced plans to launch 253.16 Mn sq. ft. of new supply across cities over the next few years. Interestingly, of this total planned supply, just 23% (approx. 57.15 Mn sq ft.) were launched in H1 FY 2025, indicating a strong new supply pipeline over the coming quarters.

Among the top 11 listed players, Bengaluru-based Prestige Group – with 75 Mn sq. ft – has the highest new supply planned over the next few years. Of this, they launched just 10.05 Mn sq. ft. (or 13%) in H1 FY2025 across geographies. In early September, the Group indicated an overall project pipeline of at least 60 Mn sq. ft.

Signature Global has the second-highest launch plan with approx. 29.3 Mn. sq. ft. over the next few years. In H1 FY2025, they launched approx. 9.5 Mn sq. ft. (32%) of their scheduled supply.

|

Listed Developers |

Planned Supply (Mn. Sq. ft.) since FY2025 start |

Launched Supply (Mn sq. ft.) in H1 FY2025 |

% Launched |

|

Prestige Estates |

75 |

10.05 |

13% |

|

Keystone Developers |

21.98 |

3.12 |

14% |

|

Godrej Properties Ltd. |

21.9 |

15.4 |

70% |

|

Sobha Limited |

16.84 |

3.53 |

21% |

|

Brigade Enterprises |

12.61 |

3.7 |

29% |

|

DLF Limited |

37 |

3 |

8% |

|

Lodha Group (Macrotech) |

10.1 |

3.6 |

36% |

|

Mahindra Lifespace |

6.42 |

0.69 |

11% |

|

Signature Global |

29.3 |

9.5 |

32% |

|

Kolte Patil |

7.97 |

2.21 |

28% |

|

Puravankara Ltd. |

14.04 |

2.35 |

17% |

|

Total |

253.16 |

57.15 |

23% |

Source: Data compiled by ANAROCK Research from listed developers’ quarterly reports

Dr. Prashant Thakur, Regional Director & Head – Research, ANAROCK Group, says “Various factors indicate that 2025 will see significant new supply added across cities, particularly by these listed developers. Amid high demand for their branded offerings, they have been aggressively tapping the capital markets via Qualified Institutional Placements (QIPs) for their expansion. Several of these players raised as much as INR 12,801 Cr via QIPs in 9M 2024. Much of these funds are earmarked for land acquisition and to launch residential projects. These players are more than adequately funded.”

“Also, the inventory overhang across the top 7 cities is at its lowest best – 14 months as of 9M 2024. This alone will prompt developers to meet the robust demand for their offerings with more supply across cities.”

Moreover, only 23% of the overall planned supply announced early in this financial year was launched in H1 FY2025, due to the general and state elections, which slowed down project approvals. With elections now over, the next few quarters will likely see multiple new launches by these developers.

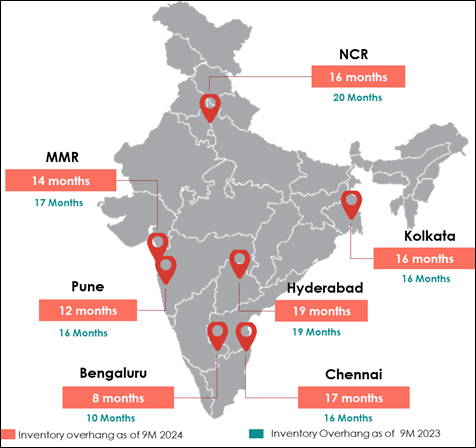

Inventory Overhang in Top 7 Cities as of 9M 2024-end

ANAROCK data shows the inventory overhang (**) across the top 7 cities down to 14 months by 9M 2024-end, from 17 months in the corresponding period of 2023. This is the lowest-best inventory overhang in the last decade. This low inventory overhang will also prompt developers to add more supply to the market.

“City-wise, Hyderabad has the highest inventory overhang of 19 months among the top 7 cities, while Bengaluru has the lowest at just 8 months,” says Dr. Thakur. “In the last two years, Bengaluru saw its unsold stock drop by 6 months while Hyderabad saw a dip of just two months. Hyderabad also saw considerable new supply infusions in the last two years.”

Source: ANAROCK Research

(*) The 11 listed players considered here have reported their new launch plans in investor presentations – Sobha Ltd., Puravankara Ltd., Prestige Estates, Brigade Enterprises Ltd., Mahindra Lifespace Developers Ltd., Godrej Properties Ltd., DLF Limited, Lodha developers (Macrotech), Keystone Developers, Signature Global, and Kolte Patil)

(**) Inventory measured in months indicates the number of months it will take for the current unsold housing stock on the market to sell at the current absorption rate. An inventory overhang of 18-24 months is considered healthy in any given period.