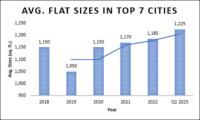

- Avg. flat sizes in top 7 cities increased from approx. 1,150 sq. ft. in 2018 to approx. 1,225 sq. ft. in Q1 2023

- MMR only city where avg. flat sizes declines – from approx. 932 sq. ft. in 2018 to approx. 743 sq. ft. in Q1 2023

- NCR saw the maximum growth in avg. flat sizes among top 7 cities – from approx. 1,250 sq. ft. in 2018 to approx. 1,700 sq. ft in Q1 2023

- Among top 7 cities, avg. flat size in Hyderabad is highest at 2,200 sq. ft., followed by NCR; MMR has lowest

- Yearly trends of avg. flat sizes in top 7 cities show Q1 2023 saw a 5% annual rise – from approx. 1,170 sq. ft. in Q1 2022 to approx. 1,225 sq. ft. in Q1 2023

Size continues to matter for Indian homebuyer, even after relative market normalcy has been restored post the Covid-19 pandemic. Latest ANAROCK data indicates that average flat sizes in fresh supply hitting the top 7 cities grew 7% in the last five years – from approx. 1,150 sq. ft. in 2018 to approx. 1,225 sq. ft. in Q1 2023. In 2022, the average flat size in these cities stood at 1,185 sq. ft., and at 1,170 sq. ft in 2021.

“MMR is the only city where average flat sizes reduced in the last five years – from 932 sq. ft. in 2018 to 743 sq. ft. in Q1 2023,” says Anuj Puri, Chairman – ANAROCK Group. “In these five years, only 2020 saw average flat sizes in MMR see an annual rise of 21% against 2019. Since 2020, homes in the region are shrinking.”

Among the top 7 cities, NCR saw the highest growth in average flat size in the last five years – from approx. 1,250 sq. ft. in 2018 to approx. 1,700 sq. ft. in Q1 2023. Developers in NCR are closely tracking demand and launching bigger homes in this region.

• Hyderabad has the highest average flat size at approx. 2,200 sq. ft. in Q1 2023, followed by NCR with approx. 1,700 sq. ft.

• In Chennai and Bengaluru, the average flat sizes stand at approx. 1,175 and 1,300 sq. ft., respectively.

• In Kolkata, average flat size was approx. 1,150 sq. ft.

• In Pune, average flat size clocks in at approx. 1,013 sq. ft.

“Before Covid-19, apartment sizes were shrinking annually to meet the demand for compact homes prevalent then,” says Puri. “The central concerns were affordability and millennials’ preference for low-maintenance homes. 2020 saw an abrupt reversal of buyer preferences. With a sudden emphasis on the WFH and study-from-home culture, flat sizes began increasing for the first time in four years.”

In 2023, property prices are heading north but the demand for bigger homes continues. Q1 2023 saw average apartment sizes in the top 7 cities increase by approx. 7% since 2018, with MMR the only outlier with average home sizes reducing around 20% in the period.

Source: ANAROCK Research

City Level Yearly Trends

The yearly trends of average flat sizes in the top 7 cities show that Q1 2023 has seen a 5% annual rise – from approx. 1,170 sq. ft. in Q1 2022 to approx. 1,225 sq. ft. in Q1 2023.

- NCR saw average flat size rise 50% – from approx. 1,130 sq. ft. in Q1 2022 to approx. 1,700 sq. ft. in Q1 2023.

- Kolkata saw flat sizes increase by 44% – from a modest 800 sq. ft. in Q1 2022 to 1,150 sq. ft. in Q1 2023.

- Hyderabad saw average flat size increase by 29% in the year – from approx. 1,700 sq. ft. in Q1 2022 to approx. 2,200 sq. ft. in Q1 2023.

- Pune saw a 16% yearly increase – from 877 sq. ft. back in Q1 2022 to 1,013 sq. ft. in Q1 2023.

- Bengaluru saw a 8% yearly jump in avg. flat sizes – from approx. 1,200 sq. ft. in Q1 2022 to approx. 1,300 sq. ft. in Q1 2023.

- Chennai saw avg. flat sizes decrease by 6% – from approx. 1,250 sq. ft. in Q1 2022 to approx. 1,175 sq. ft. in Q1 2023

- MMR saw avg. flat sizes decrease by 5% – from approx. 783 sq. ft. in Q1 2022 to approx. 743 sq. ft. in Q1 2023.

The notable exceptions of MMR and Chennai are certainly interesting. A perception among developers that there is currently sufficient existing supply of larger format homes may be factor. Also, while MMR is hyper-expensive, Chennai is a very cost-sensitive market. In both instances, increasing the supply of smaller, more affordable homes makes sense.

Copyright © 2025 | WordPress Theme by MH Themes